Effortless Car Loan Calculator

Calculator Information

The Equipment Finance Calculator calculates the type of repayment required, at the frequency requested, in respect of the loan parameters entered, namely amount, term and interest rate. The Product selected determines the default interest rate for personal loan product. The Equipment Finance Calculator also calculates the time saved to pay off the loan and the amount of interest saved based on an additional input from the customer. This is if repayments are increased by the entered amount of extra contribution per repayment period. This feature is only enabled for the products that support an extra repayment. The calculations are done at the repayment frequency entered, in respect of the original loan parameters entered, namely amount, annual interest rate and term in years.

Calculator Assumptions

Length of Month

All months are assumed to be of equal length. In reality, many loans accrue on a daily basis leading to a varying number of days interest dependent on the number of days in the particular month.

Number of Weeks or Fortnights in a Year

One year is assumed to contain exactly 52 weeks or 26 fortnights. This implicitly assumes that a year has 364 days rather than the actual 365 or 366.

Rounding of Amount of Each Repayment

In practice, repayments are rounded to at least the nearer cent. However the calculator uses the unrounded repayment to derive the amount of interest payable at points along the graph and in total over the full term of the loan. This assumption allows for a smooth graph and equal repayment amounts. Note that the final repayment after the increase in repayment amount.

Rounding of Time Saved

The time saved is presented as a number of years and months, fortnights or weeks, based on the repayment frequency selected. It assumes the potential partial last repayment when calculating the savings.

Amount of Interest Saved

This amount can only be approximated from the amount of time saved and based on the original loan details.

Calculator Disclaimer

The results from this calculator should be used as an indication only. Results do not represent either quotes or pre-qualifications for the product. Individual institutions apply different formulas. Information such as interest rates quoted and default figures used in the assumptions are subject to change.

Feel free to use our Loan Calculator

**Note: For exceeding 120 no. of payments, a group of 12 payments will be combined into a single payment number for better chart visibility.

| Period | Payment | Interest | Balance |

|---|

A car loan calculator helps you to calculate EMI , A Car Loan calculator is a basic tool which helps in calculating monthly repayments for your vehicle. It gives information about the loan amount interest and loan duration.). It will make it easy for planners by performing these calculations instantly, allowing you to have a well-managed budget. The calculator allows for customization and provides a detailed breakdown of repayment schedules, making the loan decision process more transparent and better informed. Great for seeing the difference among various loan offerings and getting the best deal.

Working of Car Loan calculator ?

- Loan Amount: The total amount you wish to take up for your Vehicle?

- Interest Rate: Enter the annual rate of interest

- Loan Duration: Select the loan duration on monthly basis or years

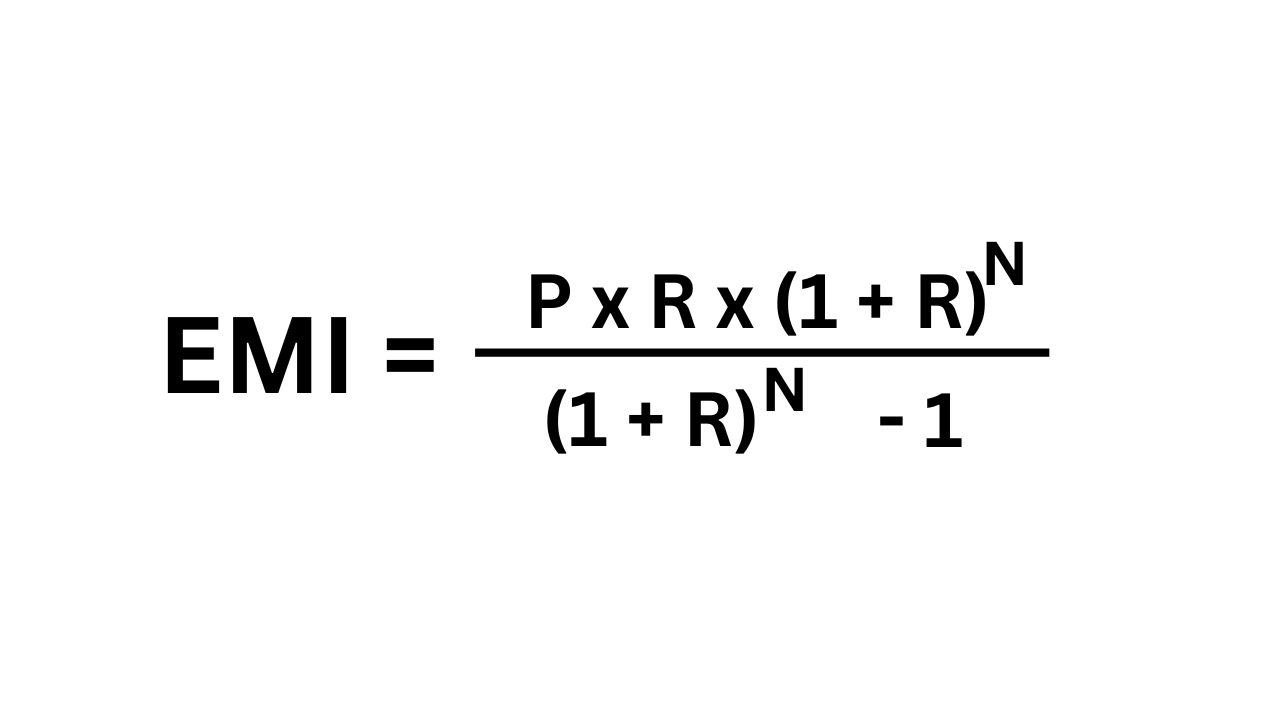

The calculator implements the common formula for EMI calculation :

EMI=P×R×(1+R)N(1+R)N−1\text{EMI} = \frac{P \times R \times (1+R)^N}{(1+R)^N – 1}EMI=(1+R)N–1P×R×(1+R)N

Where:

- P = Loan Amount or Principal

- R = Monthly Interest Rate (Annual Interest Rate/12, expressed in decimal).

- N= Loan duration in months

Example:

- Loan Amount: ₹5,00,000

- Annual Interest Rate: 8%

- Loan Tenure: 5 years (60 months)

Step 1: Convert the annual interest rate into a monthly rate: R=812×100=0.00667R = \frac{8}{12 \times 100} = 0.00667R=12×1008=0.00667

Step 2:

Result: The EMI will be approximately ₹10,138 per month.

Summary of the Loan:

- Total Repayment Amount: ₹6,08,280 (₹5,00,000 principal + ₹1,08,280 interest)

- Total Interest Paid: ₹1,08,280

This example highlights how the calculator simplifies complex calculations, giving you clear insights into your loan obligations.

How to Use the Car Loan Calculator

- Loan Amount: Enter the amount of the car loan

- Choose Loan Terms: Enter the number of years to pay it off.

- Repayment Frequency: Select the option of payments either monthly, quarterly, yearly, weekly, or fortnightly.

- Input Interest Rate: Set or maintain the interest rate variable.

- Payment Mode: Select “In Advance” or “In Arrears” for when they pay.

The calculator gives you your EMI, total interest and repayment schedule.

Advance Benefits of Utilizing the Car Loan EMI Calculator by Blink Briefs 24

- Easy to Use: The calculator is designed simply and is pretty intuitive, so anyone can use it without hesitation.

- Variable Inputs: Enter loan amount, interest rate, payback period, and payment frequency

- Flexi Payment Modes: Payment schedule – “In Advance” or “In Arrears”

- Extensive Findings: Offers EMI, overall interest and payment splits for budget preparation

- Saves Time: No more manual calculations or handling complex formulas

For more details, visit the Blink Briefs 24 Car Loan Calculator.

Essential Features of a Car Loan Calculator :

- User-Friendly: Basic design for smooth navigation

- instant calculations based on the user inputs

- Input Data: Easily manage loan amount, rate of interest and tenure.

- Results in detail: EMI, total interest payable and repayment schedule.

Car Loan Calculator: Factors Affecting Car Loan Rates :

- Principal Demand: The principal directly affects the EMI. You will pay more each month for a larger loan.

- Interest Rate: The annual interest rate imposed by the lender, which defines the cost of borrowing. High interest rates raise EMI.

- Loan Tenure: If the repayment term is longer the EMI would be lower but the total interest charged would be higher.

- Repayment Basis: Monthly, Quarterly, or Yearly payment can affect the EMI calculations.

- High Down payment: If you give a higher initial down payment, the amount of loan required and thus, EMI will decrease considerably.

- If your payment is “In Advance” or “In Arrears” how it scaffolds the EMI.

All of these factors work together to place a car loan on the affordability scales and a total cost measuring stick.